QDT

Walking for Exercise: How to Get the Most Health Benefits?

By Dr. Jonathan Su, DPT, CSCS, TSAC-F, C-IAYT — Jul 13, 2021

Latest from quick and dirty tips

Whether you’re new to investing or have been at it for decades, following some tried and true rules can give you more confidence, reduce risk, a...

ChatGPT and other chatbots like Claude and Gemini have seen stunningly rapid adoption in the last year or so. You probably remember all the AI-related...

Imagine cruising down a Mississippi highway, the sun warm on your face, the radio playing your favorite tunes. Suddenly, a tremor shakes your car. You...

If you were to walk up on a snake right now or stand on the ledge of a building 20 stories up, you’re likely to get more than a little spooked. ...

Whether you’re a Bitcoin enthusiast, believe it’s a scam, or aren’t sure what to think about cryptocurrency, it’s wise to lear...

HOST SHOWCASE

Grammar Girl

Mignon Fogarty

Mignon Fogarty is the founder of the Quick and Dirty Tips network and creator of Grammar Girl, which has been named one of Writer's Digest's 101 best websites for writers multiple times. She is also an inductee in the Podcasting Hall of Fame.

Curious State

Doug Fraser

Unexpected gems of knowledge are hidden all around us. Let’s dig them up, one offbeat question at a time.

Get-Fit Guy

Kevin Don

Get-Fit Guy will give you the fitness tools to rise above your former self and achieve the healthy balance between athletic performance and an enjoyable life.

Money Girl

Laura Adams, MBA

From credit, to taxes, to retirement, to insurance – Money Girl makes money simple so you rule your finances, make smart investment decisions, and have a richer life.

Project Parenthood

Nanika Coor, Psy. D.

Parenting is tough. But with Project Parenthood's practical advice, tips, and tricks you’ll add more balance, perspective, and fun into your family’s busy life!

Relationship Doctor

Rachel Vanderbilt, PhD

Dr. Rachel Vanderbilt is a relationship scientist whose research examines how we communicate in our romantic relationships. On the Relationship Doctor podcast, she'll share evidence-backed research on how to live, love, and communicate with your partner.

Modern Mentor

Rachel Cooke

Modern Mentor is your guide to leadership and communication, helping you craft a workplace experience you can feel good about.

Nutrition Diva

Monica Reinagel, MS, LD/N, CNS

Nutrition Diva will help you sort food facts from fiction, separate the good information from the bad, and make eating healthy just a little bit easier – and a lot saner.

Savvy Psychologist

Dr. Monica Johnson

Meet life’s challenges with evidence-based research, a sympathetic ear, and zero judgment. Savvy Psychologist uses the best of psychology to help you be happier, healthier, and most importantly, yourself.

Unknown History

Giles Milton

Unknown History brings you surprising, quirky, and remarkable tales from the past, so you can pretend you paid attention in history class!

Who Knew?

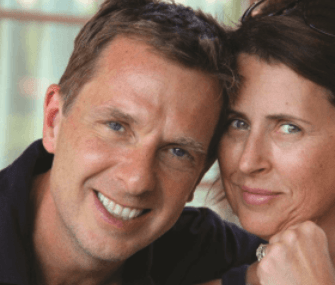

Bruce and Jeanne Lubin

Who Knew collects time-tested household tips and lifehacks to help you live better, solve everyday problems, and save money! Gain the practical wisdom you need to make the most of every day and every dollar!

Modern Manners Guy

Richie Frieman

Live a more polite life in your personal and professional worlds with Modern Manners Guy’s humorous, down-to-earth approach to 21st-century etiquette.

Sign Up for Our Newsletters

Never miss another tip! Join our list to get updates from your favorite hosts delivered straight to your inbox

Sign Up for Our Newsletters

Never miss another tip! Join our list to get updates from your favorite hosts delivered straight to your inbox